Accountants are incredibly important to a company, they do all the math that help your business have a standard budget, make more cost effective decisions and generally, handle finances so that you don’t bleed out money wise.

Hiring an accountant is an important decision every company should make. Whether you are an IT firm or in another line of business, you need a good accountant that you can trust to save you more money than you spend.

The glitch however with wanting a good accountant is that they are in high demand and the same way you need them, there is another company who are competing for the same talent as you are.

So, how do you hire a good accountant that knows their onus in such a competitive job market that faces scarcity of talent? You need to have a good job description.

Not just any kind of job description you hurriedly put together but one that is captivating enough to attract the right talent to you. In this article, we will be giving you an example of an accountant job description and tips on how to write a good accountant job description.

Click to check out our collection of best Job Description Samples

This accountant job description sample, will help you with clear directions on how to create a job description advertisement that will attract highly qualified candidates to your company, and points to include while writing your own accountant job description.

While writing an Accountant Job Description points you should include and explain clearly to your ideal candidates are:

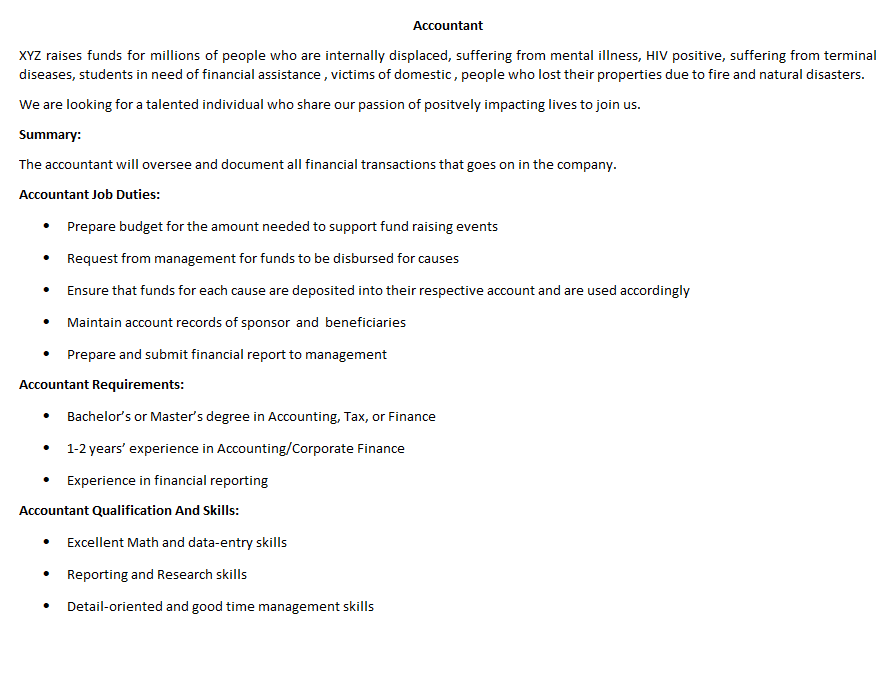

1. Company Introduction:

This is a brief introduction which you give to the candidates about your company. It should be about what your company does, why you do it, and why your company is the best place for them to work. It should also be about all the things that make your company unique.

2. Job Summary

This is a quick summary of what the accountant will do for the company if they are hired. It can just be a one-line ot two-line summary.

3. Accountant Job Responsibilites

This is a list of duties and responsiblities which your accountant will oversee and handle when they are hired.

Here is an example below:

Compile and analyze account information by preparing assets, liability and capital account entries

Enter account information to document financial transactions

Analyze accounting options to recommend financial options

Collect information; preparing balance sheet, profit and loss statement and other reports, in other to summarize the company’s current financial situation

Audit documents to substantiate financial transaction

Prepare and recommend policies and procedures for maintaining accounting controls

Provide guidance for accounting clerical staff by coordinating activities and answering questions

Collect and analyze accounting information to reconcile financial discrepancies

Complete data base backup to secure financial information

Follow internal controls to maintain financial security

Verify documentation and requesting disbursements to prepare payment

Research and interpret accounting policy and regulations in order to answer accounting procedure questions

Comply with federal, state, and local financial legal requirements by studying existing and new legislation, enforcing adherence to requirements, and advising management on needed actions

Maintain beneficiaries confidence by keeping company’s financial information confidential

4. Work Hours And Benefits:

This would be the perks and benefits the candidate will enjoy at your company should they be hired. Things like work from home option, paid leave, lunch and breakfast, transportation for staff.

5.Accountant Qualification And Skills:

A list of skills and qualifications you expect your Accountant to possess in order to be deemed eligible and qualified for the position.

Example:

Accounting

Corporate finance

Reporting skills

Punctilious

Reporting research Skills

Excellent Math skills

Confidentiality

Trustworthy and honest

Time management

Data-entry skills

6. Accountant Requirements:

This would be the specifications you set for you ideal candidate. Things like level of experience and educational background.

Bachelor’s or Master’s degree in Accounting, Tax, or Finance

1-2 years’ experience in Accounting/Finance

Experience in financial reporting

7. Call To Action

This is the part of the job description where you turn candidates into actual applicants through a call to action. Should they apply by clicking an application button or should they send their CV to an email address or a specific person at your company.

Example:

Method Of Application:

Interested and qualified candidates who wish to change the world with us, can apply by clicking the application button below.

A good job description can lead the right talent to your company. Before you write your accountant jon description, make sure you get every detail it should contain right.

For more helpful content on creating a good job desciption, read our guide on How to Write a Job Description that Will Help You Get a New Hire Fast.

You can also browse for accounting jobs in Lagos and accounting jobs in Abuja on MyJobmag webiste.

Leave a Comment