Nigeria’s labour market expanded in 2025, signalling a stronger demand for labour compared to the previous year. Total job postings rose from 90,666 in 2024 to 109,434 in 2025, representing a year-on-year growth of approximately 21%. This increase confirms that employers are not only posting more roles but are doing so at a faster pace than in the prior year.

Hiring activity also broadened across employers. The number of companies actively recruiting increased slightly from 6,136 in 2024 to 6,193 in 2025, indicating that job growth is being driven both by existing employers scaling up recruitment and by new or previously inactive companies entering the hiring market. While the growth in hiring companies is modest, the sharp rise in total job postings suggests that companies are posting more roles per employer, pointing to deeper staffing needs.

This report is based on job data collected from MyJobMag and reflects real hiring activity across Nigeria. The report draws primarily from job listings published between January 1st and December 31st 2025. These include full-time, contract, part-time, hybrid, remote, and expatriate roles, covering both paid and free listings.

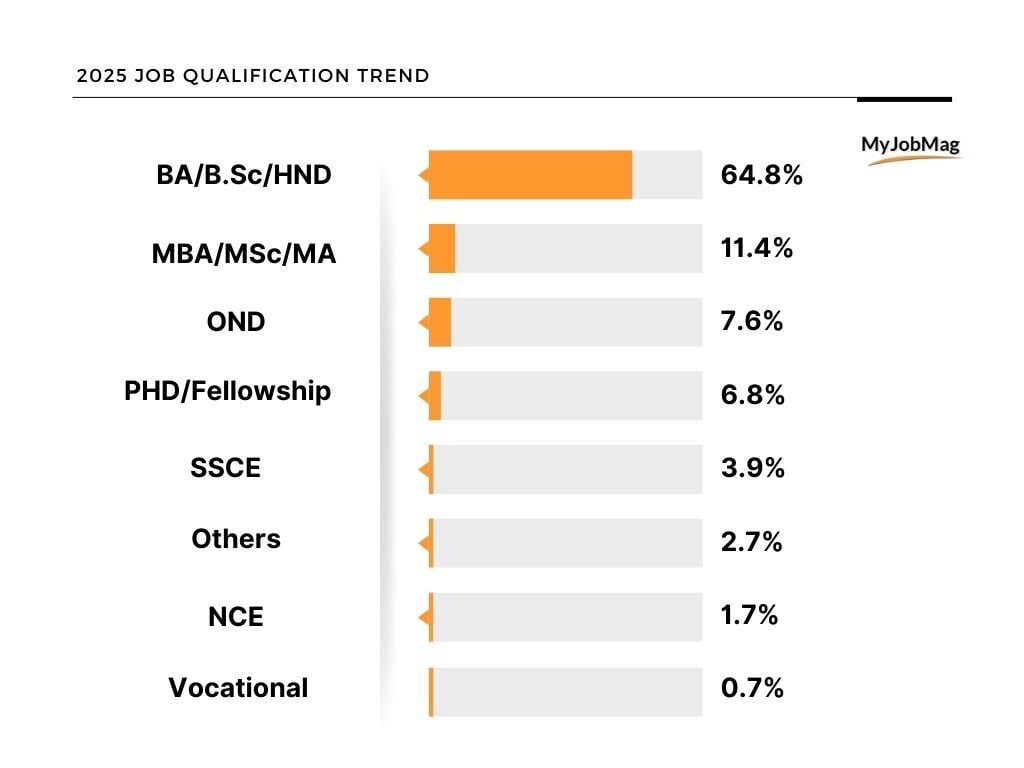

Nigeria’s job market continues to favour candidates with formal higher education. Most job openings required a Bachelor’s degree or its equivalent, making this the most in-demand qualification by a wide margin. A large majority of job openings, about 65%, required a BA, BSc, or HND, showing that employers still see this level of education as the baseline for many professional roles. Postgraduate qualifications were also in demand, with jobs requiring a Master’s degree, making up roughly 11% of openings.

In 2025, job opportunities in Nigeria were highly concentrated in a few major fields. Sales, marketing, retail, and business development accounted for the largest share of job openings, making up about 16% of all jobs published. This shows that companies are prioritising roles that drive revenue, customer growth, and market expansion.

Between 2024 and 2025, Nigeria’s job market saw the strongest growth in education, sales, and marketing roles. While most fields recorded gains in comparison to the previous year, the NGO sector witnessed a standout decline.

|

Job Field |

2024 |

2025 |

YoY% |

|

Sales/Marketing/Retail/Business Development |

14,374 |

17,425 |

+21.2% |

|

Education/Teaching |

14,243 |

17,178 |

+20.6% |

|

Engineering/Technical |

12,084 |

12,207 |

+0.1% |

|

Finance/Accounting/Audit |

9,352 |

10,209 |

+9.2% |

|

Administration/Secretarial |

6,102 |

6,497 |

+6.5% |

|

ICT/Computer |

5,931 |

6,367 |

+7.4% |

|

Media/Advertising/Branding |

5,167 |

5,503 |

+6.5% |

|

Medical/Healthcare |

4,591 |

4,862 |

+5.9% |

|

Human Resource/HR |

3,462 |

3,526 |

+1.8% |

|

Procurement/Store-Keeping/Supply |

3,174 |

3,413 |

+7.5% |

|

Project Management |

2,639 |

2,851 |

+8.0% |

|

Customer Care |

2,040 |

2,176 |

+6.7% |

|

Driving |

2,056 |

2,159 |

+5.0% |

|

Hospitality/Hotel/Restaurant |

1,984 |

2,128 |

+7.3% |

|

Internship/Volunteering |

1,889 |

2,008 |

+6.3% |

|

Graduate Jobs |

1,870 |

1,963 |

+5.0% |

|

NGO |

1,926 |

1,829 |

-5.0% |

Accountant remains the most in-demand role in 2025. Sales Executive and Driver roles follow closely, highlighting strong demand in logistics, operations, and personal transportation services. As opposed to the previous year, social media manager and sales representative make it as new entrants in the list of top job roles in 2025.

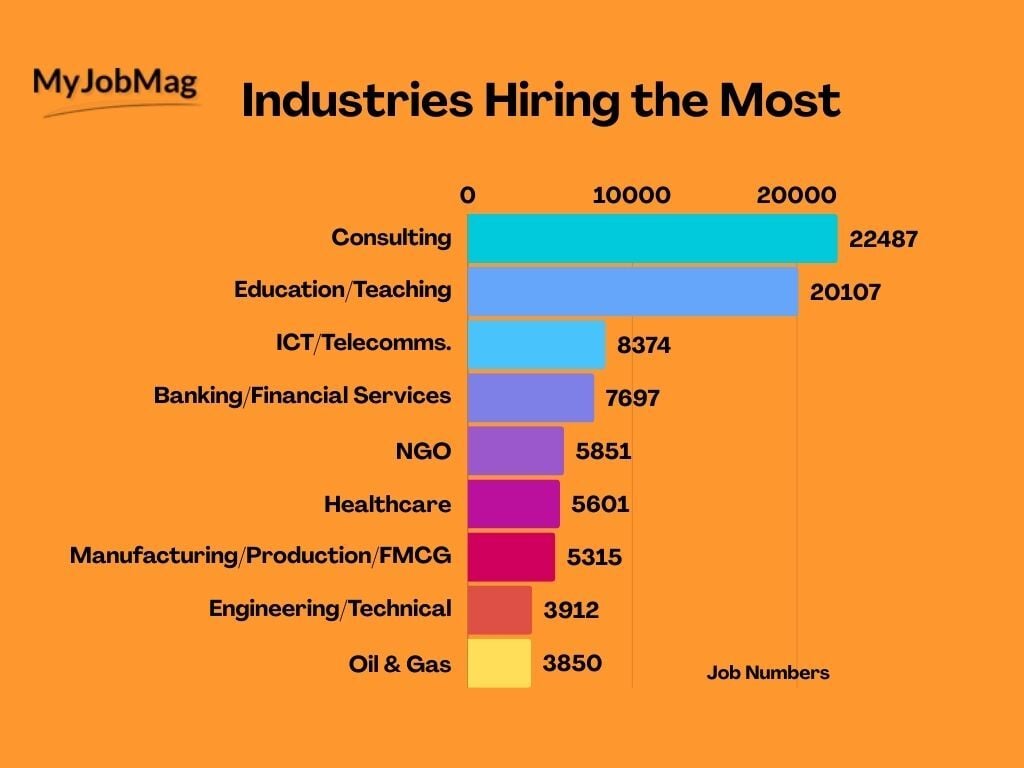

Nigeria’s hiring activity in 2025 was mostly concentrated in Consulting, Education, and ICT/Telecommunication. These 3 industries accounted for a significant share of all job postings. Job seekers targeting these industries have the greatest chance of finding work.

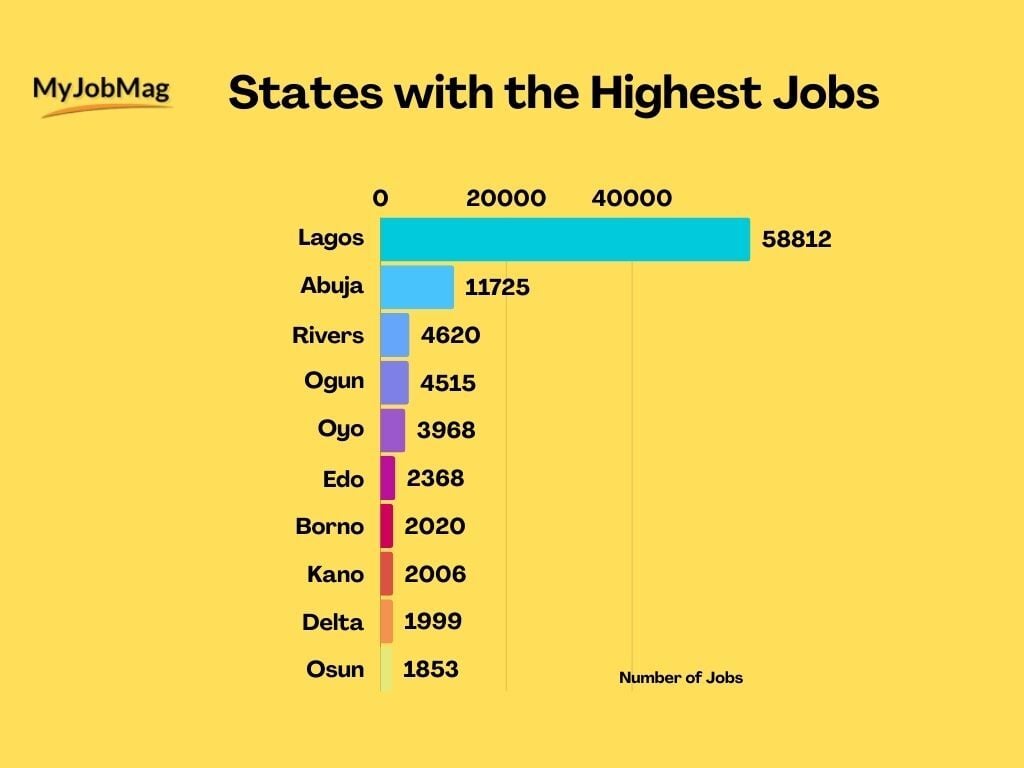

Lagos continues to dominate Nigeria’s job market, hosting more than 50% of all job openings. While Abuja accounts for about 11%, Rivers and Ogun states each contributed roughly 4%. Most northern and less urbanised states collectively accounted for less than 1% each, showing that job opportunities remain highly concentrated in major cities.

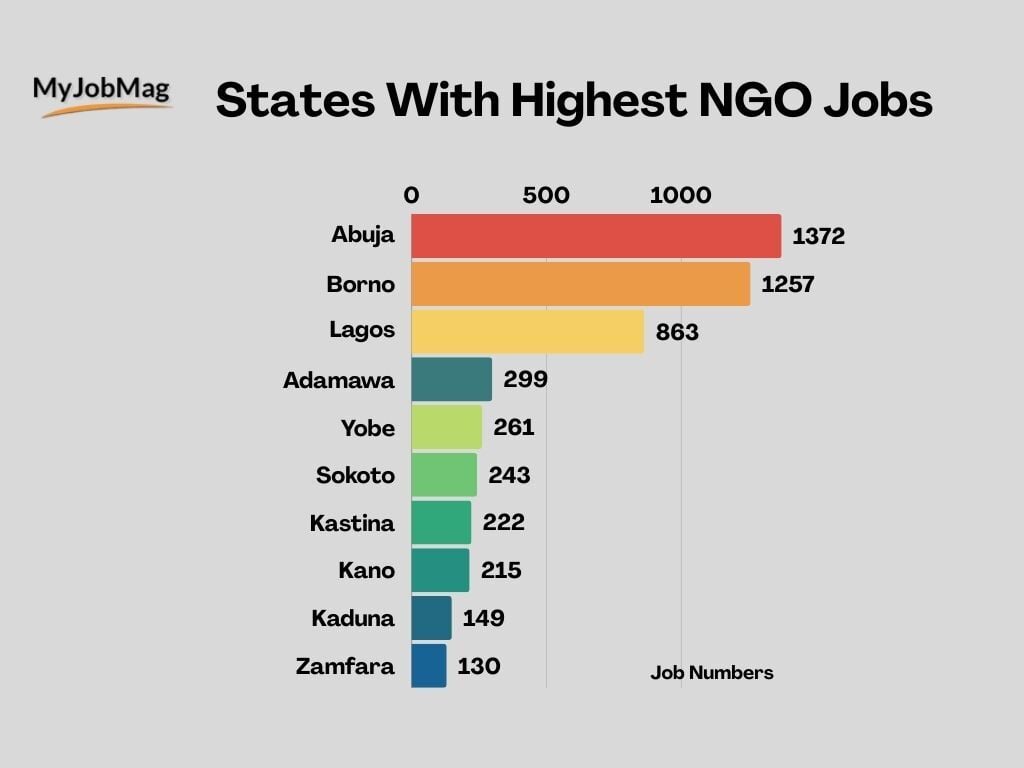

Compared to 2024, there was a slight decline in total NGO openings, suggesting that funding and organisational activity is contracting. Abuja remained the top hub, hosting around 46% of all NGO jobs, followed closely by Borno with about 42%. Lagos accounted for roughly 29%, showing a smaller share compared to its dominance in overall job postings.

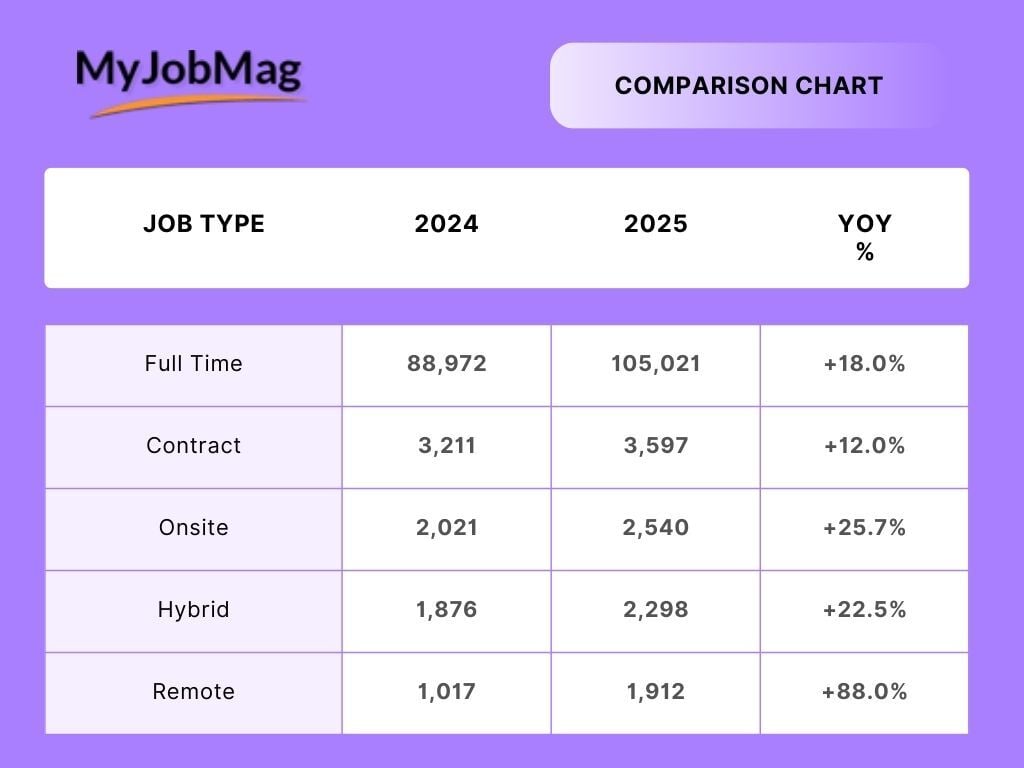

Remote work represents a small portion of total opportunities in 2025. Out of all jobs published, about 2% were fully remote, reflecting a near doubling compared to 2024. Full-time roles, however, dominated the Nigerian job market, making up around 96% of all openings in 2025. Contract and onsite positions together accounted for roughly 5%.

The biggest increases in jobs happened in Consulting, ICT, and Education, showing that businesses and technology are creating the most opportunities. In contrast, NGO hiring dropped slightly by 4.8%, suggesting less activity in the non-profit sector.

|

Industry |

2024 |

2025 |

YoY% |

|

Consulting |

19,345 |

22,487 |

+16.2% |

|

Education/Teaching |

18,500 |

20,107 |

+8.7% |

|

ICT/Telecommunication |

7,120 |

8,374 |

+17.6% |

|

Banking/Financial Services |

7,650 |

7,697 |

+0.6% |

|

NGO |

6,146 |

5,851 |

-4.8% |

|

Healthcare/Medical |

5,300 |

5,601 |

+5.7% |

|

Manufacturing/FMCG |

5,050 |

5,315 |

+5.2% |

|

Engineering/Technical |

3,700 |

3,912 |

+5.7% |

|

Oil & Gas |

3,750 |

3,850 |

+2.7% |

|

Hospitality |

3,100 |

3,244 |

+4.6% |

|

Real Estate |

2,500 |

2,588 |

+3.5% |

|

Sales/Retail |

2,250 |

2,361 |

+4.9% |

|

Food Services |

1,750 |

1,807 |

+3.3% |

|

Logistics/Transportation |

1,700 |

1,787 |

+5.1% |

|

Agriculture/Agro-Allied |

1,400 |

1,429 |

+2.1% |

|

Power/Energy |

1,100 |

1,157 |

+5.2% |

|

Media/Radio/TV |

1,000 |

1,031 |

+3.1% |

|

Building/Construction |

950 |

987 |

+3.9% |

|

Government |

900 |

953 |

+5.9% |

Nigeria’s job market is expected to continue expanding, but opportunities will remain concentrated in service- and distribution-focused sectors. Sales, marketing, and business development are likely to remain the largest employers, while engineering and production roles will grow more slowly, reflecting an economy still focused on moving goods and services rather than creating new value.

Service sectors such as consulting, ICT, education, and banking will continue to drive most new jobs, while manufacturing and oil & gas will remain limited in creating formal employment, due to their capital-intensive nature.

Emerging industries like data/AI, Internet, and blockchain are expected to grow, but their impact on mass employment will remain modest unless investment and skills development accelerate.

Regional disparities will equally persist, with Lagos and Abuja continuing to dominate job creation.

Looking ahead, the labour market will favour candidates with digital, people-oriented, and cross-functional skills.

Employers should leverage labour market insights to guide hiring and talent development, while universities and training institutions that align curricula with market needs can better prepare graduates.

Policymakers should also prioritise policies that drive job creation in high-growth industries and encourage employment outside major urban centres like Lagos and Abuja. This will help to reduce regional disparities and expand opportunities nationwide.

Leave a Comment